One of the most important aspects of financial management is making sure your figures match your bank statements by reconciling your business accounts. QuickBooks helps with this process, enabling users to rapidly reconcile and make changes as needed. Knowing how to reconcile and undo reconciliations is essential for keeping accurate financial records whether using QuickBooks Online or the desktop versions like Pro or Premier.

What is “Undo a Reconciliation” in QuickBooks?

With new features and functionalities, QuickBooks has become one of the most popular accounting software, making all accounting processes easier and more manageable. Deleting or redoing Reconciliation in QuickBooks is an exclusive tool that prevents unnecessary reconciliations.

QuickBooks allows users to reconcile accounts with a few simple clicks, saving them a lot of time over doing it manually. However, if the QuickBooks balance sheet does not match the bank statement, it is required to un-reconcile and remove a specific transaction from a completed reconciliation. This typically occurs when you add a transaction to Reconciliation by default.

In this article, we have covered all of the potential procedures that can be done to erase or undo a reconciliation in QuickBooks.

Important Key Pointers Before You Undo a Reconciliation in QuickBooks Online

Even though there is no threat of losing any data while you undo a reconciliation in QuickBooks Online, still you be careful. Here are a few key pointers that you must consider before you Undo a Reconciliation:

- Backup Company File: Before you start undoing reconciliation in QuickBooks, you must make sure to create a backup of your company file.

- Don’t Make Manual Changes: Try not to make changes in the reconciled status of the transactions to avoid encountering errors in the later stage.

- Delete Adjustment Entries: In case you have generated any adjustment entries, remove them before you undo reconciliation.

- Fix Discrepancies: Go through the transaction detail properly before you reconcile, and if you find any discrepancies, just fix them. Following this process will reduce your work on undoing reconciliation because of errors.

- Download Attachment Files: There are chances that while you undo the transactions, the attachment files get deleted. Hence, we always recommend downloading the attachment before you begin the process.

- Start with the Recent Reconciliation: Any subsequent reconciliations are also nullified when an earlier reconciliation is undone. For instance, if you reverse January’s reconciliation in May, you would also reverse February, March, and April, which could lead to mistakes. Work backward, starting with the latest reconciliation.

- Manual Transactions Remains Unchanged: Transactions that have been manually reconciled cannot be undone. It’s possible that human changes were made to transactions that are still shown in the register for the undone dates. To be certain, you can review the transaction audit history.

How Undo a Reconciliation Transaction in QuickBooks Online?

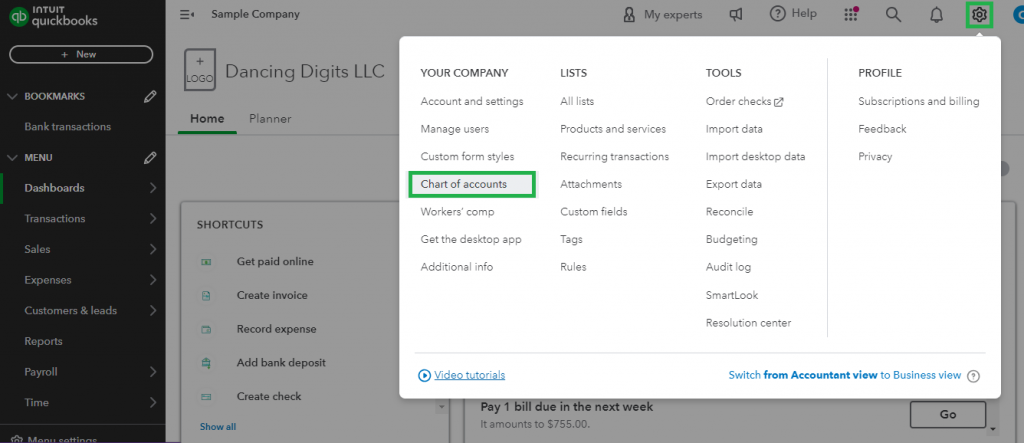

- Click the ‘Chart of accounts’ option after first clicking the Gear symbol at the top of your screen.

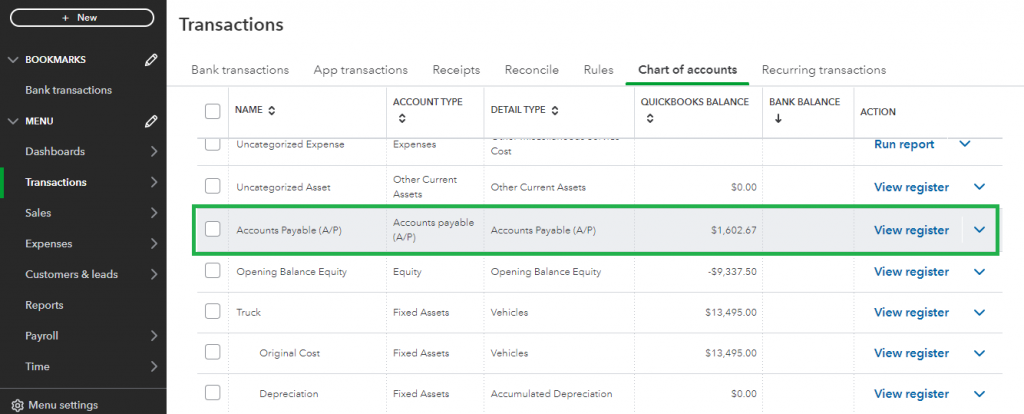

- Select the ‘View Register’ tab after find the row that corresponds to the bank account that has to be changed.

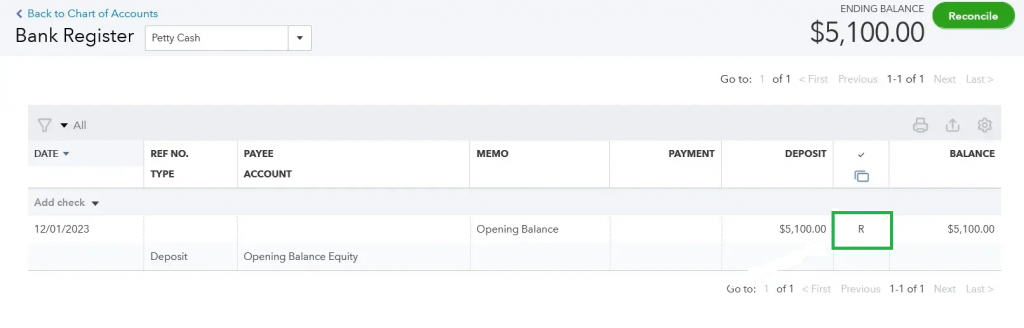

- Navigate to the “Reconcile Status” column after finding the transaction that needs to be adjusted.

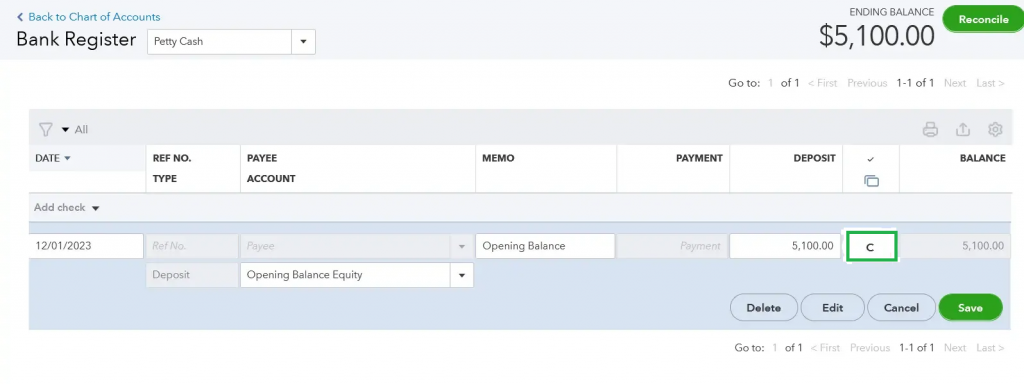

- To undo reconcile a transaction, click on it. Keep in mind that a transaction marked with a “C” is cleared, a transaction marked with a “R” is reconciled, and a field marked with an empty symbol is either cleared or reconciled.

- Click on the “Save” tab to confirm the your modification.

- Reconciliations can be undone by selecting and adjusting each transaction separately, with the reconciliation report or bank statement serving as a guide if necessary.

Read also: How to Activate ViewMyPaycheck for QuickBooks Workforce?

How to Undo a Client’s Reconciliation in QuickBooks Online Accountant (QBOA)?

Learn how to undo reconciliations for your clients. Here are the steps that QuickBooks Online Accountants can follow to undo the reconciliation:

- Open your QuickBooks Online Accountant on Chrome for smoother processing.

- Now, log into your customers’s company

- Navigate to the Accounting menu.

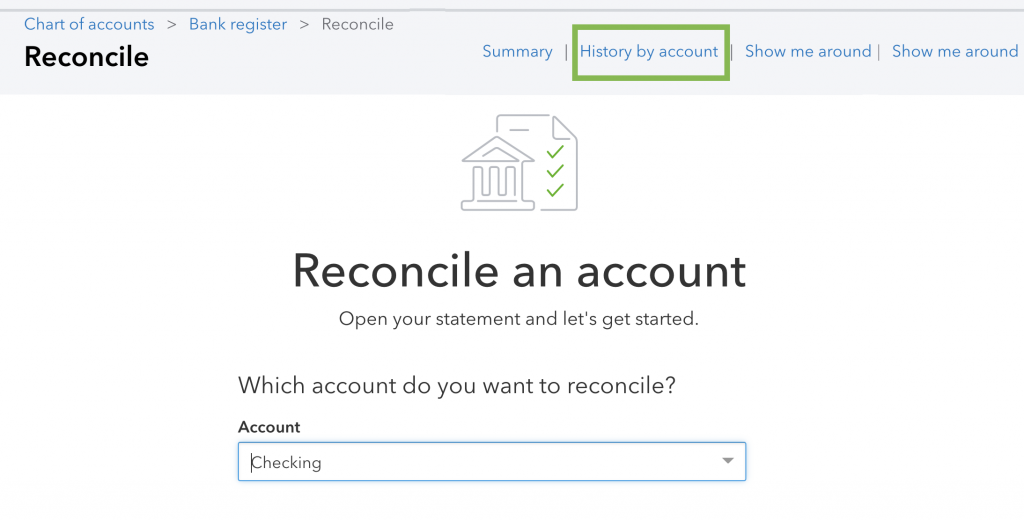

- Click on the Reconcile tab from the dropdown.

- Click open the History by Account option from the top right corner.

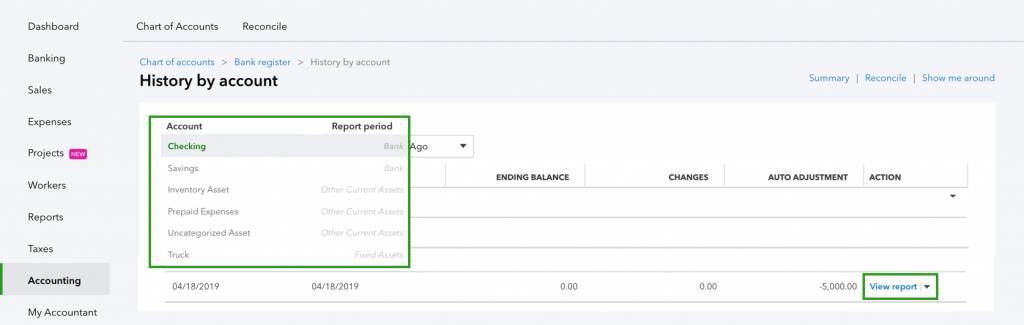

- From the dropdown, you must select the date range and the account that you want to reconcile.

- You will be able to find the reconciliation on the list.

- Click open the ‘View Report’ option.

- Check for any discrepancies in the report and edit if there’s any requirement from the client’s side.

- Once all data is reviewed, click on the dropdown▼ and then click on the Undo option.

- Hit the Yes button and then click on the Undo button for confirmation.

Important Note: The Undo option is only available in your client’s company file. In case you cannot see the option to Undo, make sure that you have opened the Client’s Company file in your QuickBooks Online Accountant.

How to Undo Reconcile Transaction in QuickBooks Desktop?

The steps below can be used to reverse reconciliation in just one step if you’re using the QuickBooks Desktop edition for QuickBooks Pro or Premier:

- Open QuickBooks Desktop, then select the ‘Banking’ option.

- From the drop-down menu, choose ‘Reconcile’.

- Select the account and the date, then click “Undo Last Reconciliation” after entering the balance.

- Click “Continue” on the resulting screen to confirm your selection.

- It’s best to find and record any inconsistencies before reversing the reconciliation in order to stop mistakes from happening again.

How to Resolving Reconciliation Discrepancies in QuickBooks Online?

Your bank statement and QuickBooks’ ending balance must line up when utilizing QuickBooks Online for reconciliation. There’s no need to freak out if there are differences; just take the following actions to find and fix the problems and guarantee a smooth reconciliation procedure.

The following are the common causes of ending balance problems: improper opening or beginning balance.

- Incorrect entry for the ending balance.

- Managing several transactions.

- Deleting known accurate transactions.

- Adding the absentee transactions.

- Eliminating transactions that do not match.

- Taking care of transactions that are a little off.

- Examining for errors in financial institutions.

How to Fix Reconciliation Issues in QuickBooks Online?

Step 1: Examine the opening and beginning balances.

Verify correctness before moving forward.

Step 2: Check and Edit the Entered Ending Balance

Use the “Reconciliation Window” to verify and adjust the ending balance.

Step 3: Merge Various Transactions

If the transactions were handled as a single record by your bank, combine them in QuickBooks.

Step 4: Get Rid of Known Good Transactions

Note any transactions that match the information in QuickBooks on your bank statement.

Step 5: Include Any Missing Transactions

Using your bank statement as a guide, enter any missing transactions in QuickBooks.

Step 6: Get Rid of Mismatched Transactions

In QuickBooks, go over and remove any transactions that don’t appear on your bank statement.

Step 7: Handle Inconsistent Transactions

When there are slight differences in a transaction, speak with your accountant.

Step 8: Examine Financial Institution Errors

Examine any possible mistakes made by the bank or credit card provider.

Step 9: Complete the Reconciliation

You may safely finish the reconciliation process in QuickBooks Online after settling differences and balancing your accounts.

Conclusion

Finally, QuickBooks ensures the accuracy and consistency of your business finances by offering a simple way to reconcile and undo reconcile transactions. Correcting mistakes, changing balances, and keeping accurate financial records all depend on the capacity to undo reconciliations.

Whether utilizing Desktop versions such as Pro or Premier or QuickBooks Online, the detailed instructions guarantee a seamless undo reconciliation procedure. QuickBooks enables companies to effortlessly handle financial complexities by allowing them to modify individual transactions and make use of the ‘Undo Last Reconciliation’ option.

One important lesson is to analyze errors thoroughly and avoid future hiccups by proactively discovering inconsistencies before undoing reconciliations. QuickBooks remains a ray of efficiency in the accounting world, enabling companies to function with assurance regarding their financial precision.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

How to Avoid common Reconciliation-Related Errors?

knowing how to perform bank reconciliation in QuickBooks is useful, but you should watch out for these frequent faults or mistakes:

- Missed Reconciliation: Regular reconciliation gives you a comprehensive picture of your financial situation. The likelihood of errors compounding increases with each reconciliation interval.

- Posting a Debit as a Credit: Reversal errors are frequent, and they occur when you post a credit as a debit, leading to erroneous books.

- Duplicate Payments: When there are no established procedures for paying invoices and new team members are added, this can occur.

How to Undo Reconciliation in QuickBooks Online?

- Go to the ‘Accounting’ menu after logging into your QuickBooks Online account.

- From the drop-down option, choose “Reconcile.”

- Click the “Undo” button after selecting the reconciliation you want to undo from the “Action” column.

- Click “Yes” to confirm your choice.

- The reconciled transactions will be automatically reversed by QuickBooks Online and marked as “not cleared” after confirmation.

- After that, you can make any required corrections and reconcile the accurate transactions.

How to undo Reconciliation in QuickBooks Desktop?

- Proceed to the ‘Banking’ menu.

- Click “Reconcile,” Click “Undo Last Reconciliation” after selecting the account that contains the transactions you wish to have reversed.

What Should I Consider Before Undo Reconcilie a Transaction?

Make sure you comprehend all possible repercussions before undo reconciling a transaction. A previously balanced book may be impacted by undo reconciling, which could cause disparities in your financial reports. Prior to implementing any such modifications, speak with a financial advisor or accountant. Additionally, keep in mind that you’ll need to examine and, if necessary, fix the impacted transactions before readjusting them after undo reconciling.

Why is QuickBooks Online Bank Account Reconciliation so important?

It is essential to reconcile your bank accounts in QuickBooks Online to ensure that the data on your bank statement and the transactions you have recorded match. By identifying anomalies like sudden drops in account balances or possibly fraudulent transactions, this procedure enables preventative steps to stop financial problems like overdraft fees or failed checks. Frequent monthly reconciliation helps QuickBooks clean up after errors and enables accountants to get involved early if there are any disparities.

How to undo Reconciliation in Quickbooks Online Accountant?

To undo reconciliation in QuickBooks Online Accountant, you must go to the Accounting menu, and then click open the Reconcile tab. To open targetted accounts transactions, click on ‘History by Account’ and then select the View Report option. If you find any discrepancies, click on the dropdown and select the ‘Undo’ option.

Will I lose my previous data while undoing reconciliation in QuickBooks Online Accountant?

Yes, there are high chances of losing the attachments while undoing reconciliation. You must download the attachment files to avoid losing them. Additionally, if you reconcile for January in July, then data for February, March, April, May, and June will also be undone. So, make sure you undo last month’s transaction first (i.e. June) and then move to other months, one by one.

Can I undo the reconciliation in QuickBooks Desktop?

No, you cannot undo the reconciliation in QuickBooks Desktop. This feature is only available in QuickBooks Online Accountants. However, you can manually undo the reconciliation in QuickBooks. No feature can undo reconciliation automatically.

Can You Reconcile 2 months in QuickBooks Online?

Yes, you can reconcile 2 months in QuickBooks Online. You must remember that while reconciling 2 months, always start in chronological order. However, while you are undoing the reconciliation, start with the recent month past, and never skip undoing months transaction that lies in between.

Why can’t I see the Undo Reconciliation option in my QuickBooks Online Accountant?

You can’t see the undo reconciliation option in your QuickBooks Online Accountant because you are not viewing your client’s company file. You can only access this feature in your client’s company file in your QuickBooks Online Accountant.

+1-800-596-0806

+1-800-596-0806