QuickBooks Online allows businesses to manage payroll schedules with flexibility. Changing the pay period is essential for accurate payroll processing. This guide explains the steps to modify the pay period in QuickBooks Online to ensure employees receive timely and correct payments.

What is the Pay Period in QuickBooks?

Before proceeding with the steps, understand the different pay schedules available in QuickBooks.

- Weekly: You can choose a specific day of the week, like Thursday or Friday, to pay your employees, leading to 52 payouts per year.

- Bi-Weekly: If you pay employees every other week, such as in the 1st and 3rd weeks of the month, it totals 26 pay periods per year.

- Monthly: Monthly payments are those made once per month, resulting in 12 payments per year.

- Semi-Monthly: You can make semi-monthly payments by scheduling them twice a month, such as on the 15th and 30th. This results in 24 payments per year.

Conditions to Change The Pay Period in QuickBooks Online

Two conditions are applied for making changes in the pay schedule in QuickBooks Online.

- If You’ve Not Submitted the First Payroll: You can edit the dates, times, and other details in the pay schedule only if you have not released the first payroll.

- If You’ve Not Removed Your First Payroll Submission: You’re not allowed to make changes in the pay period if the data from running the first payroll is still there.

So, if you submitted the payroll, then delete it. After it is removed, you can edit the pay period in QuickBooks.

How to Change the Pay Period in QuickBooks Online?

Here are the steps required to change the pay period in QuickBooks Online such as edit, delete, or make changes in frequency, date, name, and next date of payment release.

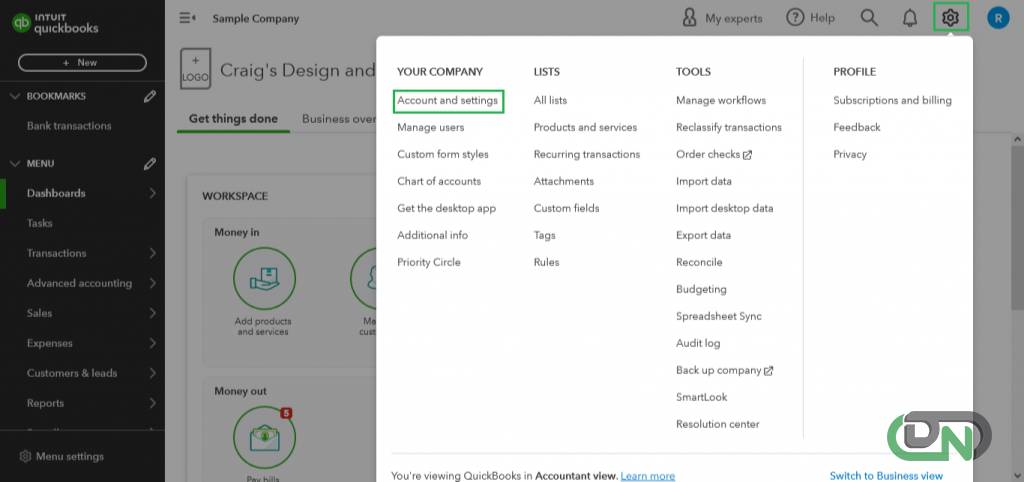

- Click on the gear icon present in the upper right corner of the dashboard.

- Select the “Account and Settings” from the dropdown’s Your Company’s section.

- Click open the “Payroll” tab present on the left side of the dashboard.

- Payroll Schedule will be displayed.

- Click on “Edit Schedule” written in blue colored text.

- Make the required changes, and click on the “Save” button.

Read more-- Set up and Manage Payroll Schedules in QuickBooks

Conclusion

You can change the pay period in QuickBooks Online by making edits in the Payroll tab in the Account and Settings. This article has a step-by-step guide, that will lead towards making edits in the pay period successfully. To ensure payroll submissions are managed well, you must delete the first submitted payroll details.

Frequently Asked Questions (FAQs)

How to edit the pay period in QuickBooks Online?

To edit the pay period in QuickBooks Online, go to the settings menu bar, and click on the ‘Accounts and Settings’ tab present below the Your Company section. Then, click on the ‘Edit Schedule’ button and click on the ‘Save’ button to make the changes permanent.

How can I make changes in the Pay Schedule?

You can make changes to the pay schedule by clicking on the Edit Schedule button in the payroll tab. Then, you will get the option to make changes in the payment period, Date, Time, Name, and Next Payment Date. Once you make the required changes, click on Save.

How can I change the frequency of Payment from Weekly to Bi-Weekly in QuickBooks Online?

To change the frequency of payment from weekly to bi-weekly, go to the Payrolls section, and click on the edit schedule button. After this, click on the ‘Weekly Payment Schedule’ option, and from the dropdown, select Bi-weekly.

Are there any limitations for making edits in the pay period?

Yes, there are limitations to applying changes in the Pay Period of QuickBooks Online. The user must ensure that there are no data saved from the previous payroll released. Hence, if you have released the first payroll, then you must delete the data. Once previous pay period data is removed, you can make edits in the pay periods.

What is the process of changing the pay period in QuickBooks Online Payroll?

The process of changing the pay period in QuickBooks Online Payroll involves steps such as clicking on the settings menu, selecting the ‘Account and Settings’ option, and going to the payroll section. After you do all this, you will have to click on the ‘pay schedules’ option and edit the pay as it is required.

Can the pay period be changed for individual employees in QuickBooks Online?

Yes, you can change the pay period for individual employees in QuickBooks Online. To do so, you are required to go to the ‘Employees’ tab that is present under the ‘Payroll’ menu. After this, click on the ‘Payroll’ menu, select the name of the employee, select the ‘Edit employee’ option, and choose the new pay schedule from the dropdown list.

What is the pay period in QuickBooks Online Payroll?

The recurring time on which any employee receives his/her payment is known as the pay period in QuickBooks Online payroll. If you have a small business, then it’s on you to set it up based on the time you think is right for your employees’ payments.

How do I adjust the payroll period in QuickBooks Online?

To adjust the payroll period, you will have to go to the ‘Payroll’ settings, then select the ‘Pay Schedule’ option, and then you can make further adjustments to the payroll period settings.

What is the process of changing the payment status in QuickBooks Online?

The process of changing payment status in QuickBooks Online involves the location of the specific transaction from the database of QBO, and then updating then by clicking on ‘Payment Details’. Lastly, after making the successful changes, you must click on the ‘Save’ button to secure all the changes that have been made to the payment status.