With its robust features, QuickBooks Enterprise is a solution that can grow with your firm. It is a vital tool for companies trying to improve decision-making and optimize operations since it includes sophisticated capabilities for inventory control, financial management, and customizable reporting.

In today’s article, we will include the best QuickBooks Enterprise reports, which may greatly enhance financial and business management.

What is QuickBooks Enterprise Reporting?

Numerous reports that offer in-depth insights into different aspects of business operations are available in QuickBooks Enterprise. To manage money, keep an eye on performance, and make wise strategic decisions, these reports are highly important.

In order to boost your business procedures and operations, we’ll go over the most crucial QuickBooks Enterprise reports in this article.

Save Time, Reduce Errors, and Improve Accuracy

Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

List of Reports in QuickBooks Enterprise

Here is the list of the most important QuickBooks Enterprise Reports for financial management of a business:

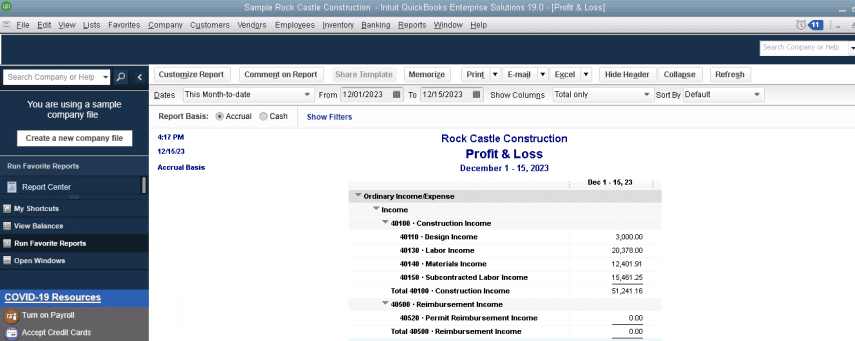

1. Profit and Loss Report

One of the most important financial statements for every organization is the Profit and Loss (P&L) report, sometimes referred to as the Income Statement. It presents an overview of the company’s earnings for a given time period, highlighting its capacity to turn a profit through either cost-cutting, revenue-growth, or both.

Significant Features

- Period Comparison: Enables evaluation of the performance over various periods, like month-over-month, year-over-year.

- Customizable Filters: Customize the report based on specific requirements like project, customer, or location.

- Expenses and Revenue Analysis: Offers a comprehensive account of all the expenses and incomes.

How to Utilize it?

Examining the P&L report on a regular basis facilitates easy understanding of the company’s profitability. It provides information on potential areas for revenue growth and cost reduction, directing operational and strategic planning decisions.

2. Balance Sheet

The Balance Sheet report offers an overview of the financial position of the company at a particular moment in time. It provides information on assets, equity, liabilities, and provides key insights into owns and what it needs to pay.

Significant Features:

- Liabilities Summary: Describes all of the outstanding debts, including mortgages, loans, and accounts payable.

- Assets Analysis: Includes a list of all the company’s assets, such as cash and its receivables and inventories.

- Equity Overview: Displays the retained earnings and equity of the owner

How to Utilize it?

This report is crucial for evaluating stability and financial health of the company. Lenders, investors, and management use it frequently to assess a company’s creditworthiness and make sure the business is financially stable.

3. Cash Flow Statement

The Cash Flow Statement presents the net inflows and outflows of cash over a given time period, broken down into financing, investing, and operating operations. It aids companies in assessing how effectively they handle their cash situation.

Significant Features:

- Investing Activities: Money earned or utilized for investment-related activities, like making equipment purchases.

- Operating Activities: Cash issued from core business operations

- Financing Activities: Cash flows concerning to repaying or borrowing equity or debt

How to utilize it?

This report is essential for predicting future cash demands and confirming that the company has enough liquidity to pay its debts. It assists in seeing possible issues with cash flow before they get out of hand.

4. Accounts Receivable Aging Report

In the accounts receivable aging report, unpaid client bills are grouped by age, which also displays the length of time each invoice has been past due. For better cash flow management and collection management, this report is crucial.

Significant Features:

- Customer Information: Lists those customers who have overdue invoices or whose payments are pending

- Age Classifications: Breaks down the receivables into present, 30-6o days, 60-90 days, and over 90 days overdue

- Total Receivables: Offers a complete amount of the outstanding receivables

How to Utilize it?

By routinely examining this report, businesses can quickly accelerate collections by identifying slow-paying consumers and taking appropriate action. It lessens the chance of bad debts and supports a stable cash flow.

5. Accounts Payable Aging Report

In the Accounts Payable Aging Report the outstanding vendor bills are categorized by age. It helps firms better manage their payables by displaying the length of time that each account has been past due.

Significant Features:

- Vendor Information: It includes a list of vendors who amounts are due or have outstanding bills

- Total Payables: Offers a complete amount of the outstanding payables

- Age Classification: Breaks down the receivables into present, 30-6o days, 60-90 days, and over 90 days overdue

How to Utilize it?

This report is helpful for controlling cash outflows and making sure that bills are paid on time in order to keep excellent vendor relations and prevent late fines. It facilitates future financial demands forecasting and budgeting.

6. Inventory Valuation Summary

The Inventory Valuation Summary report provides a quick overview of the worth of the inventory. Businesses may effectively manage their stock levels with its assistance as it provides information on the quantity and worth of each inventory item.

Significant Features:

- Total Value of Inventory: Offers the total value of all the inventory items

- Valuation Process: Utilizes either average cost method or the FIFO method as chosen in QuickBooks

- Item Details: Provides the list of every inventory item with its total value and quantity on hand

How to utilize it?

This reports helps in making wise purchasing decisions, keeping an eye on inventory levels, and recognizing overstocked or understocked items. It is crucial for controlling working capital and making sure the company has the appropriate stock to satisfy demand without using up excessive amounts of cash.

7. Job Costing Report

The Job Costing Report offers comprehensive details regarding the expenses related to particular jobs or projects. It assists companies in keeping tabs on project costs and comparing them to allocated sums.

Significant Features:

- Budget vs Actual: It distinguishes between budgeted amounts and actual costs to classify variances

- Cost Analysis: Detail costs classification like materials, labor, and overhead

- Job Profitability: Displays the profitability of every project or job

How to utilize it?

This report is essential for enterprises that work on a project basis, such consultants or construction companies. It aids in making sure projects stay within allocated budgets and in locating potential areas for cost reduction.

8. Sales by Customer Summary

The Sales by Customer Summary report gives a summary of the sales that were made to each customer over a certain time frame. It aids companies in identifying their most important clients and income streams.

Significant Features:

- Period Comparison: Enables distinguishing of sales over various periods

- Top Clients: Recognizes the top clients by sales volume

- Customer Analysis: Includes a list of every customer with the total sales amount

How to utilize it?

This report facilitates targeted marketing and sales tactics by identifying the consumers who make the most revenue contributions. It also helps to spot possible problems with dropping sales from certain clients.

9. Sales by Item Summary

The Sales by Item Summary report gives a summary of each inventory item’s or service’s sales over a certain time frame. Businesses can use it to monitor how well their goods and services are performing.

Significant Features:

- Period Comparison: Enables comparison of sales over various periods

- Top Products: Recognizes the top selling services or products

- Item Analysis: Locates the top selling services or products

How to utilize it?

From this research, product strategy and inventory management can both benefit. In order to inform marketing and purchase decisions, it aids in recognizing seasonal trends, sluggish sellers, and best-sellers.

10. Budget vs. Actual Report

The report for Budget vs. Actual compares actual income and expenses with budgeted amounts, emphasizing variances. It is an important tool for financial control and planning.

Significant Features:

- Complete Analysis: Offers information by customer, project, or account

- Customizable Periods: Enables comparison over various periods

- Variance Breakdown: Displays differences between actual figures and budgeted figures

How to utilize it?

This report assists in tracking financial performance against plans, recognizing sections where the business is spending more or not performing well. It helps taking informed changes to financial and budget strategies.

11. Statement of Cash Flows

With the Statement of Cash Flows report, you can get complete insights into the cash used and generated by the business during a particular period. It classifies cash flow into investing, operating, and financial activities.

Significant Features:

- Complete Insight: Offers information on cash outflows and inflows

- Customizable Periods: Enables comparison over various periods

- Cash flow Classifications: Analyzes cash inflows into investing, operating, and financing activities

How to utilize it?

This report is important for comprehending how nicely the business handles its cash. It assists in planning for future cash requirements and making sure that the business can address its financial duties.

12. Trial Balance

The Trial Balance report offers a complete summary of the balances in the particular general ledger accounts. It makes sure that the total credits equal the total debits, authenticating the correctness of the accounting system.

Significant Features:

- Credit and Debit Totals: Makes sure the total credits is equal the total debits

- Account Balances: Includes a list of all the particular general ledger accounts together with their balances

- Customizable Periods: Enables a review of certain periods

How to Utilize it?

This report is important for authenticating the precision of the accounting records prior to preparing the financial statements. It also assists in recognizing and rectifying any irregularities in the accounts.

13. Custom Summary Report

The Custom Summary Report enables businesses to prepare highly customized reports, depending on their particular requirements. Furthermore, it offers flexibility in choosing layout, data, and filters.

Significant Features:

- Complete Insights: Offers complete insights catered to your particular requirements

- Customizable Layout: Select the data fields, filters, and layout

- Flexible Periods: Enables comparison over various periods

How to utilize it?

This report can be used to create customized reports that meet specific business needs. It facilitates the analysis of data from multiple angles and provides more in-depth understanding of business operations.

14. Vendor Balance Summary

The total amount owing to each vendor is shown in the Vendor Balance Summary report. It facilitates vendor connections and payables management.

Significant Features:

- Outstanding Balances: Displays outstanding balances for every vendor

- Vendor Information: Includes a list of every vendor with total money owed

- Customizable Periods: Enables review for particular periods

How to utilize it?

This report facilitates cash outflow management and timely bill payment. It helps with budgeting, estimating future financial requirements, and keeping positive vendor connections.

15. Customer Balance Summary

An overview of each customer’s outstanding balance may be found in the Customer Balance Summary report. It facilitates receivables management and guarantees prompt collections.

Significant Features:

- Outstanding Balances: Displays outstanding balances for every customer

- Customizable Periods: Enables review for particular periods

- Customer information: Includes a list of every customer with the total amount owed

How to utilize it?

This report facilitates the management of cash inflows and guarantees timely invoice collection. It helps keep a healthy financial flow and lowers the chance of bad debts.

16. Purchase by Vendor Summary

The Purchase by Vendor Summary report gives a summary of all the purchases made from each vendor over a certain time frame. It facilitates managing vendor relationships and purchase pattern analysis.

Significant Features:

- Period Comparison: Enables comparison of purchases over different time periods

- Top Vendors: Recognizes the top vendors with the help of the purchase volume

- Vendor Breakdown: Includes a list of every vendor with the total purchase amount

How to utilize it?

This report is useful for managing vendor relationships and understanding purchase trends. It helps in planning next purchases and negotiating better terms with vendors.

17. Payroll Summary

Payroll costs for a certain time period are summarized in the Payroll Summary report. It helps companies effectively manage their payroll by providing information on wages, taxes, and deductions.

Significant Features:

- Complete Payroll Data: Includes detailed payroll information for every employee

- Employee Analysis: Includes a list of every employee with total taxes, wages, and deductions

- Customizable Periods: Enables review of particular periods

How to Utilize it?

In order to control payroll costs and guarantee that tax laws are followed, this report is crucial. Payroll budgeting and well-informed employment and compensation decisions are facilitated by it.

18. Sales Tax Liability Report

In the Sales Tax Liability report an overview of sales tax collected and payable for a given time period. Businesses may assure compliance with tax legislation and manage their sales tax liabilities with its assistance.

Significant Features:

- Complete Tax Data: Includes complete tax data for every transaction

- Tax Analysis: Includes a list of tax accumulated and owed by jurisdiction

- Customizable Periods: Enables review for certain periods

How to utilize it?

This report is important to manage sales tax liabilities and guarantee compliance with tax legislation. It facilitates the preparation of sales tax returns and helps to prevent fines for incomplete or late submissions.

19. Transaction List by Date

In the Transaction List by Date report, a comprehensive list of every transaction for a given time period is provided. It facilitates the examination and confirmation of every financial transaction.

Significant Features:

- Customizable Filters: Enables filtering by account type, transaction type, and other criteria

- Complete Transaction List: Includes a list of all transactions with information such as type, date, and other amount

- Flexible Periods: Enables review for particular periods

How to utilize it?

With this report, you can analyze and confirm all financial transactions. This report also assists in finding and fixing any mistakes or inconsistencies in the accounting records.

20. General Ledger

In the General Ledger Report, a thorough accounting of every transaction entered into the general ledger accounts. It is necessary to examine all of the company’s financial transactions.

Significant Features:

- Customizable Filters: Enables filtering by date, account, and other criteria

- Complete Transaction Data: Includes complete transaction data for every account

- Account Information: Includes a list of all transactions by account with information like type, date, and account

How to utilize it?

Examining the entire financial operations of the company requires this report. It facilitates the preparation of financial statements and the assurance of accounting record accuracy.

21. Income & Expenses Reports

This QuickBooks Enterprise tool assists you in managing and keeping an eye on the financial success of your company. These reports offer a thorough breakdown of your revenue streams and spending categories, assisting you in determining where your money is coming from and how it is being used. Through the examination of these data, users can discern patterns, such as rising expenses or sales, and make well-informed decisions to improve efficiency and profitability.

These reports are also essential for predicting and budgeting. By routinely reviewing these reports, you can assess performance in relation to your allocated funds, which will enable you to stay on course and make any required corrections.

22. Time Reports

Businesses that need to monitor and control staff time for precise project management, customer billing, and payroll processing need these reports. These reports assist firms to make sure that labor expenditures are correctly accounted for and paid appropriately by offering comprehensive insights into how time is spent on various tasks and projects.

Employers can use time reports to keep an eye on worker productivity, make sure labor rules are followed, and gain a better understanding of how much time is needed for certain tasks. Making educated judgments on labor management, project scheduling, and cost allocation requires having access to these information.

23. 1099 Reports

For companies that use independent contractors or freelancers, 1099 reports are crucial since they record the non-employee remuneration that is paid all year long. These reports follow payments that are eligible to be reported on Form 1099-NEC according to IRS guidelines.

The total payments made to each contractor are also summarized in this report to guarantee compliance with tax requirements. These payments must be reported to the IRS and the contractor by January 31st of the subsequent year.

It is simpler to compile and submit the required paperwork when the contractor’s name, address, tax identification number, and payment amount are included in the 1099 report. Making sure that your 1099 reports are accurate is essential because mistakes can lead to fines from the IRS. By enabling you to create and examine these reports on a regular basis, QuickBooks Enterprise streamlines this process and guarantees that all qualified payments are appropriately recorded.

24. Income Tax Report

These reports guarantee that your company accurately and effectively complies with its tax requirements. For the purpose of preparing taxes, these reports gather financial information on income, expenses, credits, and deductions. These reports assist firms in accurately calculating tax penalties by offering a comprehensive breakdown of taxable income.

Furthermore, income tax reports provide information on the tax consequences of different financial transactions made throughout the year. They make it possible for companies to more effectively plan and coordinate their tax-related choices, like when to recognize income and take deductions for expenses. Making use of income tax reports can result in substantial tax savings as well as improved financial planning for upcoming tax years.

Final Words

QuickBooks Enterprise provides an extensive range of reports that can greatly improve financial and business management. Businesses may assure financial stability and growth, make well-informed decisions, and obtain deep insights into their operations by routinely reading these reports.

These reports give you the vital information you need to be successful, whether you’re tracking inventories, managing cash flow, or reviewing profitability.

If you still require any further assistance, you can reach out to our team of QuickBooks experts who have the right expertise to deal with such issues.

Accounting Professionals, CPA, Enterprises, Owners

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

==============================================================================

Frequently Asked Questions

Q1: Why QuickBooks Enterprise Reports is so Crucial for Businesses?

Ans: Reports from QuickBooks Enterprise offer in-depth analysis of a range of business operational topics. Their assistance is essential in guaranteeing financial stability and expansion as they assist in performance monitoring, financial management, and well-informed strategic decision making.

Q2: How do the Actual vs. Budget Report help in Financial Planning?

Ans: The Budget vs. Actual Report highlights differences between budgeted and actual income and expenses. It supports the process of keeping track of financial results relative to goals and modifying financial strategies and budgets with knowledge.

Q3: How to Create a Custom Report in QuickBooks Enterprise?

Ans: Businesses can build highly customized reports based on their unique needs using the Custom Summary Report. It offers customization options for data, layout, and filters to enable more in-depth understanding of how well a firm is performing.

Q4: Which QuickBooks Report will be more Helpful for Financial Performance?

Ans: The most helpful report for comprehending financial performance is the Profit and Loss statement. It demonstrates the company’s capacity to turn a profit by summarizing revenues, costs, and expenses over a given time period.

Businesses may find areas where costs can be reduced or income can be raised by routinely analyzing the Profit and Loss report. This information can then be used to inform strategic planning and operational changes.

Q5: Which QuickBooks Report will be Helpful for a Financial Snapshot?

Ans: A Balance Sheet Report provides the most helpful financial overview. It provides information on the company’s possessions and debts by listing assets, liabilities, and equity at a particular point in time. This report, which gives a clear picture of the company’s financial condition, is crucial for evaluating the stability and health of the company’s finances.