By keeping the track of your spending you can easily manage your budget and the revenue growth. In case you face any risk due to underestimating or overestimating your income will be the result of inaccurate spending tracking, which can also cause you to lose out on tax deductions during tax season and cause cash flow issues.

Your employees are also impacted by expense tracking, especially if you compensate them for genuine business expenses they incur out of pocket. These charges include travel expenses, industry education, business lunches, office supplies, and much more. Saving money can also be achieved by appropriately managing these employee reimbursements.

Using QuickBooks, you can easily keep track of your out-of-pocket costs and reimbursements, as well as manage your budget before it gets out of hand.

About QuickBooks Reimbursement

If your employees have paid for business expenditures out of their own wallets, you must reimburse it to them with non-taxable money. As none of your payroll tax forms show this type of payment.

The process of paying back to an employee for the costs which they have incurred while representing the organization is known as reimbursement. This can include the cost of travel, office supplies, or other expenses which are associated with the firm. Accurate financial reporting and improved cash flow management depends on the recording of reimbursement.

The ability to classify and associate reimbursed costs with particular personnel in QuickBooks facilitates the management and oversight of the business’s spending. The accountability and openness of financial transactions are preserved with the aid of this tracking. It also guarantees that the financial records appropriately represent all refunded amounts.

How to Record Reimbursement in QuickBooks Desktop?

When you record a reimbursement in QuickBooks Desktop, you must first ensure that the charges are properly classified in the financial tracking and then document it in the reimbursed expenses. Add the amount that was repaid to the original account as a negative expense. By doing this, the accounting system’s integrity is improved and the financial records which are maintained are correct. Establish a dedicated account in QuickBooks prior to documenting a reimbursement:

Step 1: Set Up a Reimbursement Account

Following are the steps of creating a reimbursement account in QuickBooks Desktop:

- Navigate to the Chart of Accounts.

- Press the “New” button.

- Choose the account type “Expense.”

- Choose a title that sounds comparable, like “Reimbursements.”

- Save it and exit.

Step 2: Recording of the Expense

Following are the steps of entering an Employee-Incurred Expense by using QuickBooks Desktop:

- Press the “+ New” button.

- Click “Expense.”

- Select the vendor or employee by using the payee dropdown option.

- Enter the required information, such as the amount, date, and mode of payment.

- Click on the “Reimbursements” account in the Category column.

- Save and exit.

Step 3: Recording of the Payment

In QuickBooks Desktop, Paying an Employee:

- Press the “+ New” button.

- Depending on the mode of reimbursement, select “Check” or “Expense.”

- Select vendor or employee.

- Click on the “Reimbursements” account in the Category column.

- Enter the amount that will be reimbursed.

- Put away and end.

See also: How to Reimburse Employees in QuickBooks Desktop & Online?

How to Record Reimbursement in QuickBooks Online

It is advised that you document the reimbursement of a personal expense as an expense or a checks.

Step 1: Keep a Record of the Business Expenses Which you have Paid with personal funds

- Choose Journal Entry: Select Journal Entry by clicking the + New tab.

- Expense Account for the Purchase should be Added: For the purchase on the first line, you have to choose the expense account.

- Enter the Amount of the Purchase: The purchase amount should be entered in the Debits column.

- Select Owner’s equity or Partner’s equity: Select Partner’s equity or Owner’s equity from the menu.

- Enter the same amount for the purchase: Enter the same purchase amount in the Credits field.

- Close Now: Hit the Save and the exit keys.

Step 2: Select the Method in Which you would like to Reimburse the Money

Regarding reimbursements there are two choices which you have, they are:-

Option 1: Recording of Reimbursement as a Check

- Click on the Check after clicking on add New button.

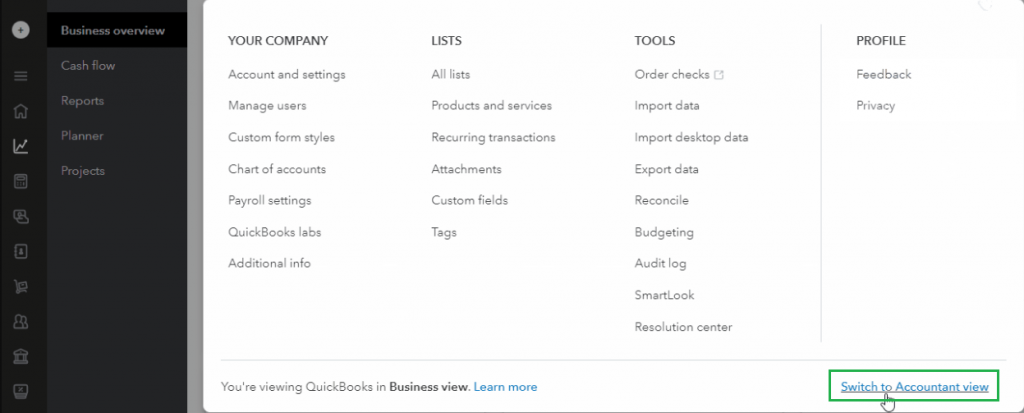

- Navigate to the menu and click on the Settings tab.

- Select the option Switch to Business view or Accountant view.

- To Reimburse the Personal Funds, Go to the following Bank Account: Select a bank account which is to be utilized for the personal money reimbursement.

- Partner’s equity or Owner’s equity can be added by clicking on the appropriate option under the Category column.

- Enter the Reimburse Amount that is you have to input the amount that needs to be reimbursed.

- Close: Click on the Save and Close button.

Option 2: Recording of the Reimbursement as an Expense

- First you have to choose an Expense after clicking on add New button.

- Navigate and Select the bank account that was utilized to return the personal funds.

- Partner’s equity or Owner’s equity can be added by clicking on the appropriate option under the Category column.

- Enter the reimbursement amount in this field.

- Lastly, Click the Save and Close keys.

How to Record an Owner’s Expense Reimbursement in QuickBooks Online?

The procedures to document the owner’s expense are listed below.

Step 1: Partner/Owner’s Personal Funds are used to Pay Business Expenses

- Select the Journal Entry by clicking the Plus (+) icon in QuickBooks Online.

- To add an expense account, type it on the first line and then debit the amount of the expense.

- Select one account i.e an Owner’s Equity or Partner account, then credit it with the same amount.

- In the end, Click the Save and close button.

Step 2: Record the Owner’s Reimbursement

- To access Expense, use the Plus (+) icon and then select Expense.

- Select the bank account from which the reimbursement was made.

- Choose either a Partner account or Owner’s Equity, select either option, then type the amount in the first line.

- Click the Save and Close tabs.

Read more: How to Import Employee Expense Reimbursement to be paid?

How to Record Client Reimbursed Expense in QuickBooks Online?

You may keep track of the money which you received from your clients by setting up a retainer deposit. You can then record the money which you have spent or which you were paid for by your clients as a transaction for reimbursable expenses.

Follow the following steps which are explained below:

- After hovering over the Vendors menu, select a Vendor Centre.

- Now open the bill and then select the Items tab.

- Enter the item in the Amount column along with the amount.

- Select the Save & Close tabs.

After that, link the billable expense to an invoice that you make.

- Click on Generate Invoices: Select Create Invoices after navigating to the Customers menu.

- Aim for the Client: Select the Customer from the drop-down menu under the Customer tab.

- Selecting of Choice: To add to these invoices, select the Billable Time/Costs from the menu. Select the unbilled time and expenses, and then click the OK tab.

- Next to the Date, Place a Checkmark: Select the Items tab, check the box next to the date, and then press OK.

- Close Now: Lastly, hit the Save and Close buttons.

How to Record Employee Reimbursement in QuickBooks Online?

You have two options if your employees used their own money to cover a business expense: pay them right away or record the charge first and pay them afterwards.

Following are the steps which you need to perform for this:

Pay Your Employee Now

- Click on the Check or Expense tab. Select the Expense or Check tab after clicking on the New button.

- Select your Employee’s name from the Payee dropdown menu.

- Add a liability account by selecting the Category from the dropdown options of the Liability.

steps to be followed:

Adding of New Account

- Select the Chart of Accounts after clicking on the Settings tab.

- Next, Enter the name of your account by pressing on the New button.

- Select the Account Type and the Detail type by using the drop-down menus.

- Mark check or tick sign on the subaccount. In the event that this account is a sub account, choose the Parent account which the sub account belongs to .

- Enter Opening Balance and then the start date in the given field, whether you are selecting a Bank, Asset, Credit card, Liabilities, or Equity account.

- You can optionally add a description to this account in order to provide more details.

- Click on the Save button.

Creating of Taxable Reimbursement item

- To Access Payroll & Employees: Navigate to payroll and then select Employees.

- Choose the Staff Member: Select the Employee.

- Select Start/Edit: Select Start or Edit option under the Pay types.

- Select Reimbursement: By swiping down to the Additional Pay Types menu select the Reimbursement.

- Include a Fresh Pay Type for Reimbursements: If there is already a reimbursement pay type in the Common pay types section in the drop-down menu then you have to add another one. Click on add another Reimbursement type in order to add a new one.

- Enter the Amount: Enter the amount as you execute payroll, or the type of default amount which you want.

- Rename the Form of Payment: Click on the Edit icon in order to change the name of this pay type to reimbursement.

- Last Step: Once you are done, click on the save button.

Extra Information

Add Further Details here, Such as:

- Amount: Enter the sum that you owe to your employee. If the tracking or making of the amount is billable for the several consumers then divide it up into distinct line items.

- Billable: Select the option to credit the cost to your customer’s invoice by checking the box (Optional).

- Client: If you want to monitor the costs for a particular client or customers, select one from the drop-down menu (Optional).

- In the last click on the Save and exit button.

See Also: How to Track Reimbursed Expenses in QuickBooks?

How to Record the Expense for Future Payments

Step 1: Choose the Journal Entry

- Select the Journal Entry by clicking on add New button.

Step 2: Option in First Line

- Click Account and select your liability account.

- The amount which you owed to your employee is to be entered in the Credits.

- Search and look for your employee’s name by navigating to the Name dropdown menu.

Step 3: Option in Second Line

- Choose the appropriate expense account from the Account section for the purchase made by your employee.

- Enter the amount of the purchase under Debits.

Step 4: End of Steps

- Press the Close and Save buttons.

- You can now pay them with a cheque or cost after logging in to your journal entry.

How to Check Your Employee Reimbursements

You can run a transaction detail report in case you haven’t paid the full amount to your employee. By this you can find out how much you have to owe to your employee. Follow the following steps for it:

Find the transaction details by account.

Navigate to Reports and look for the Transaction Detail by Account.

Click on the Customize tab.

Select the Customize tab once the report has opened.

Choose Your Transaction’s range and the Report Period from the drop-down menu.

Choose the range of your transaction by clicking on the Report period drop-down menu located under the General section.

Select the Group With a drop-down menu and an Employee

Choose the Group by navigating the drop-down menu and then Employee from the Rows/Columns Section.

Create the Liability Account and the Employee Reimbursement Account by selecting the Distribution Account from the drop-down menu.

In the Filter section, select the Distribution Account drop-down menu and then either the liability account which you created or the Employee Reimbursement account.

Select Your Employee from the drop-down menu and Enter their Name.

Enter the name of your employee after selecting the Employee option from the drop-down menu.

Note: Leave this set to All if you want the report to list all of your outstanding debts to workers.

At the end Run Report

At the end, you have to click on the Run report button.

How to Record Employee Reimbursement in QuickBooks Online Payroll?

When a company expense is incurred by one of your workers by using their own finances, it is best to record that expense at that time and then reimburse it to the employee later.

Recording of the Expenses

Before you can pay your staff, you must first record the expense.

Create a Liability Account to track costs as soon as workers submit it.

Follow the following steps in order to create a new account:

- Incorporate the Account by setting its account type as Liabilities.

- The Account should be saved under Other Current Liabilities.

- Designate Other Current Liabilities in the tax form area.

- Give your account a meaningful name, such Employee Expense Reimbursements Payable.

- Finally, click on the Save button.

Adding of the Expense as a Journal Entry

- Select the Journal Entry by clicking on add new button.

- In First Line

- Under the Account section, choose your liability account.

- Enter the amount which you have to owe your employee in Credits.

- Select the Name from the dropdown menu and find your employee’s name.

- In the second Line

- Click on the account that corresponds to the expense that your employee made under Account.

- The purchase amount should be entered in the Debits field.

- Press the Save and Close buttons.

Payroll can now be used to pay your employee after the expense has been recorded.

Paying to Your Employees

In QuickBooks, add or modify pay types.

- Navigate to Payroll and then pick the Employees.

- Select the worker.

- Select the Start or Edit option from the Pay types.

- Click on Reimbursement after selecting Common pay types.

- Enter a blank for your Recurring Amount.

- Press the Save button.

Take a look at the Reimbursement Mapping.

- Proceed to the upper right-hand Gear icon and select the Payroll Settings.

- Select the Pencil symbol in Accounting.

- Select the Pencil symbol after swiping down to Wage Expenses.

- After choosing the liability account which you created earlier, go via Reimbursements.

- Click “Save” and then “Done.”

Conclusion

Paying back an employee, client, or other individual for money they spent out of pocket or for money they overpaid is known as reimbursement. A few instances include reimbursement for business expenses, insurance premiums, and overtaxes. Maintaining correct financial records and transparency in the books is crucial for bookkeepers, accountants, and small business owners alike. This includes recording reimbursements.

Looking for a professional expert to get the right assistance for your problems? Here, we have a team of professional and experienced team members to fix your technical, functional, data transfer, installation, update, upgrade, or data migrations errors. We are here at Dancing Numbers available to assist you with all your queries. To fix these queries you can get in touch with us via a toll-free number

+1-800-596-0806 or chat with experts.

Frequently Asked Questions

Which Journal Entry Pertains to Reimbursement?

Reimbursable expenses incurred by workers require a journal entry or accounting treatment. This is because the expenses are legitimate company expenses, thus the P&L impact is recorded at the time the employee spends the money rather than when the business reimburses them.

Is Reimbursement a Type of Account?

The liability account known as Employee Reimbursements will receive any reimbursements you give to employees.

Does Reimbursement incur Costs?

Money returned to a client or employee as recompense is known as expense reimbursement. Employee expenditure reimbursement includes paying for meals, communications, travel or business expenses, and other expenses.

Is Payment an Obligation or an Asset?

The reimbursement can be deducted from the expense in the profit and loss statement and is shown as a distinct asset on the balance sheet. The liability is not greater than the amount recorded for the anticipated reimbursement.

Is Compensation a Source of Income or Expense?

The money that was received from the other party in these circumstances ought to be noted as revenue rather than as a reimbursement of costs. Only earnings from revenue-generating operations, such as the provision of goods or services, should be reported.

+1-800-596-0806

+1-800-596-0806